The Only Enterprise Logic Layer

Built for Life & Retirement

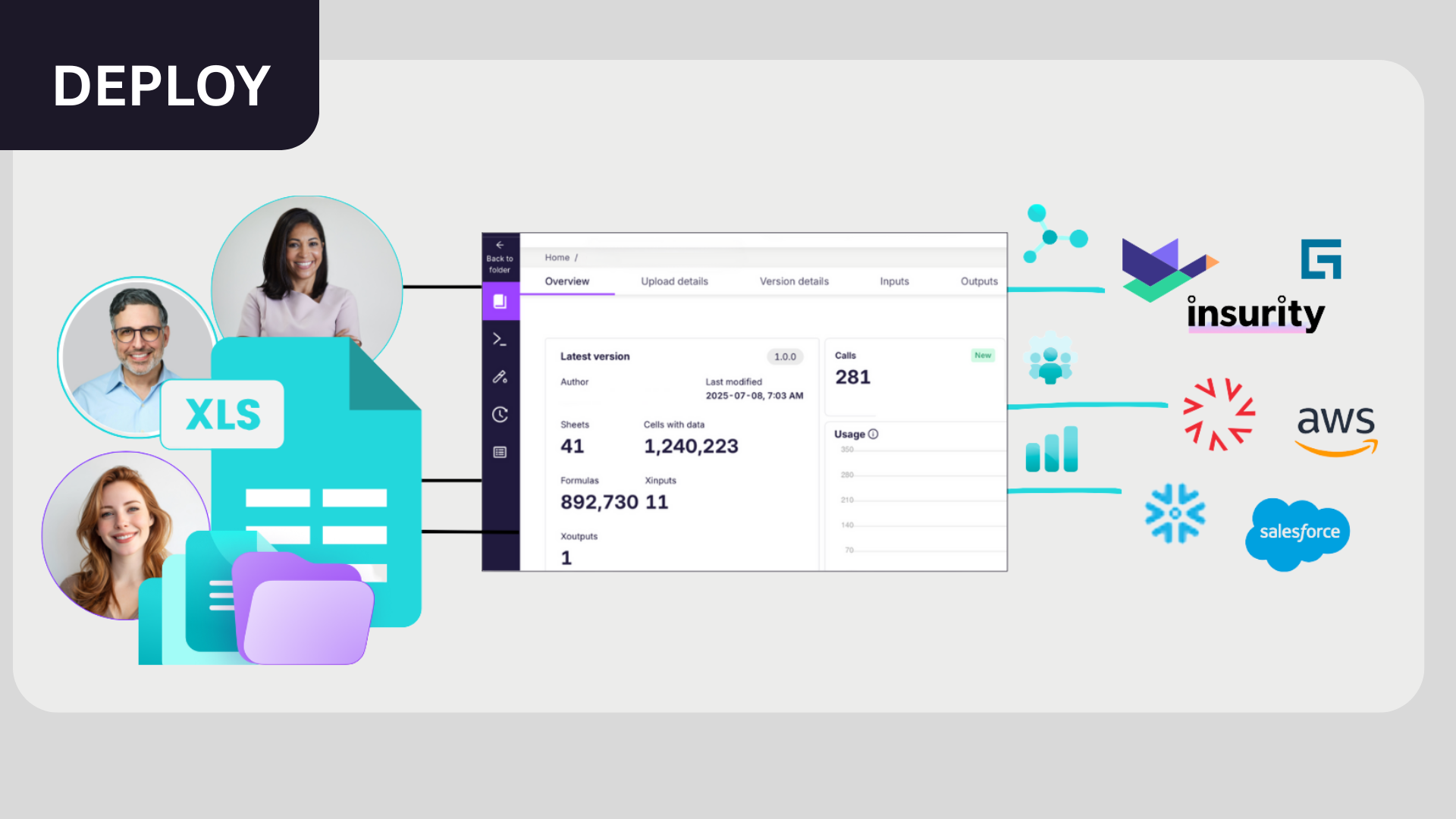

Transform Excel-authored actuarial work into governed high-performance APIs

that scale across illustrations, admin, and digital channels.

Build. Deploy. Govern. Adapt. Analyze. Integrate—everywhere.

Excel-Authored & API Executed

Modernizing illustrations, actuarial modeling & product pricing, and admin system calculations

Coherent unifies how insurance logic is created, controlled, executed, and evolved. Replace fragmented spreadsheets and handoffs with a governed lifecycle built for modern pricing, actuarial modeling illustration, and product teams.

Control the Core of Your Products

Launch Faster, and Win More Business

Free IT from Costly Rebuilds

Strengthen Compliance

Modernization Solutions for Life & Retirement

Faster, smarter, and with complete transparency

From actuarial spreadsheets to client-ready PDFs, Coherent automates illustration workflows end to end—reducing risk for carriers and delivering faster, clearer experiences that advisors and customers rely on.

Transform how you build, deploy, and maintain illustration platforms with a governed foundation to power illustrations across portals, distributors, admin systems, and internal tools.

Publish illustration logic as a single API that connects to portals, CRMs, vendor platforms, in-force systems, and even your existing illustration system.

- One source of truth across portals, aggregators, and admin systems

- Consistent calculations and disclosures everywhere

- Versioning, approvals, and audit trails by default

- Eliminates duplicate builds and vendor lock-in

Weeks, not months

by reducing illustration development and testing cycles

$300K+ saved

by cutting costly IT projects and third-party illustration vendor fees

Scales in seconds

by enhancing current systems with Spark's API-driven logic

Cloud-native performance, enterprise control with the flexibility of Excel

Coherent replaces black-box systems and manual workarounds with cloud-native performance, enterprise control, and the flexibility of Excel. Actuarial teams can use the skills they already have to start faster, test smarter, and deliver models the business can trust

- Run Complex Models Faster

- Scale Stochastic Modeling

- Build and Test Modular Models

- Eliminates manual reconciliation work

Runtimes Reduce by 99%

run thousands of simulations in under 2 minutes

35% Fewer

Audit Findings

with built-in version control and full calculation logs

80% Faster

Testing Cycles

freeing actuaries to focus on analysis instead of rework

30M Records Processed in 1 Hour

proving Coherent scales to the largest actuarial datasets

De-risk implementations by externalizing actuarial logic

Coherent externalizes actuarial calculations from systems of record and runs them as governed, production-ready services. Logic is owned, versioned, tested, and audited outside the admin system, while PAS platforms focus on orchestration. Your actuarial logic becomes easy to validate and fast to change without being embedded inside vendor code.

Externalized calculations integrate seamlessly into administrative systems, enabling a single, consistent skillset to develop and maintain logic across platforms. By removing system-specific constraints, insurers accelerate product implementations from months to weeks and reduce ongoing maintenance to days, freeing IT teams to focus on higher-value initiatives.

- Business owns & tests logic—bridging the gap between business & IT

- Faster implementations—product launches in weeks, not months

- Safer migrations—parallel testing, conversion validation patterns

- Reduced vendor dependency—IT focuses on integration, not coding logic

One platform.

End-to-end unified intelligence.

Build insurance logic faster, smarter, and with complete transparency

Enable spreadsheet-based actuarial modeling without proprietary languages. Move faster with externalized assumptions, sub-model orchestration, and parallel runs for pricing, sensitivity testing, and experience studies.

Author Core Logic

- Stochastic, nested scenarios, assumption sets, large-scale runs

- Externalize assumptions, orchestrate sub-models

- Parallel compute + performance scaling

- Repeatability + auditability

- Integration to data sources and downstream reporting/workflows

Turn insurance logic into an enterprise asset

Instantly Deploy Illustrations & Product Configuration

Run models and calculations as high-performance services outside Excel. Power illustrations, admin systems, and digital channels in real-time . Externalize logic for integration across portals, distributors, internal systems.

DECISION EXECUTION

- High-Performance APIs

- Real-Time Quotes

- Cloud-Compute Power

- Multi-Channel Deployment

Execution is fast, consistent, and reliable at scale

Insurance-grade governance and compliance

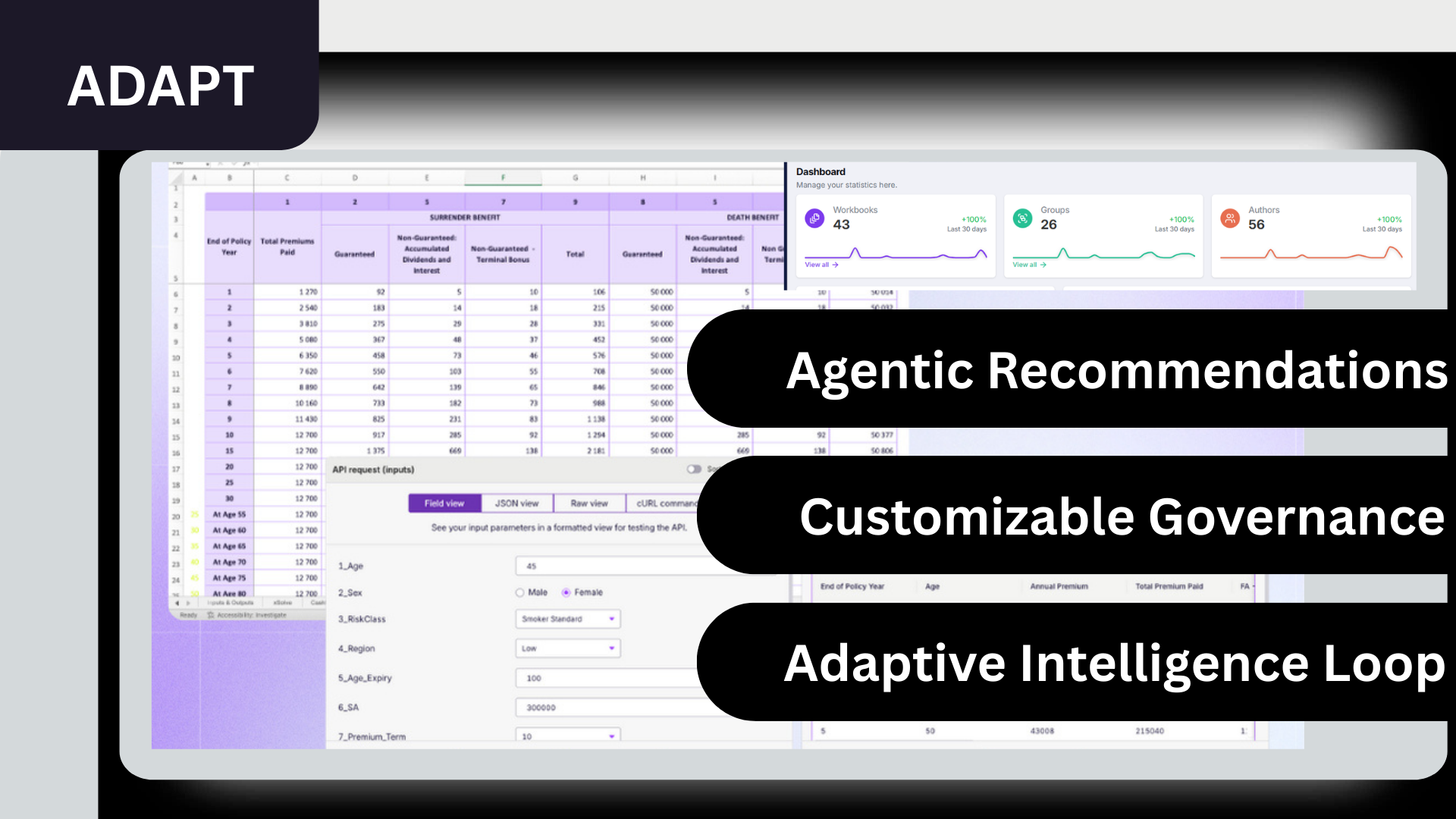

Replace email chains with enforceable audit trails. Manage versioning, automate approval workflows, and ensure every change is documented, tested, and compliant before production. Human-in-the-loop approval flows that regulators and audit teams love. Promote logic to production with impact assessment, automated testing, and complete transparency.

GOVERNANCE & CONTROL

- Version Management

- Configurable Approval Workflows

- Automated Testing & Validation

- Release Management and Change Evidence

Models are consistent, auditable, and ready for production.

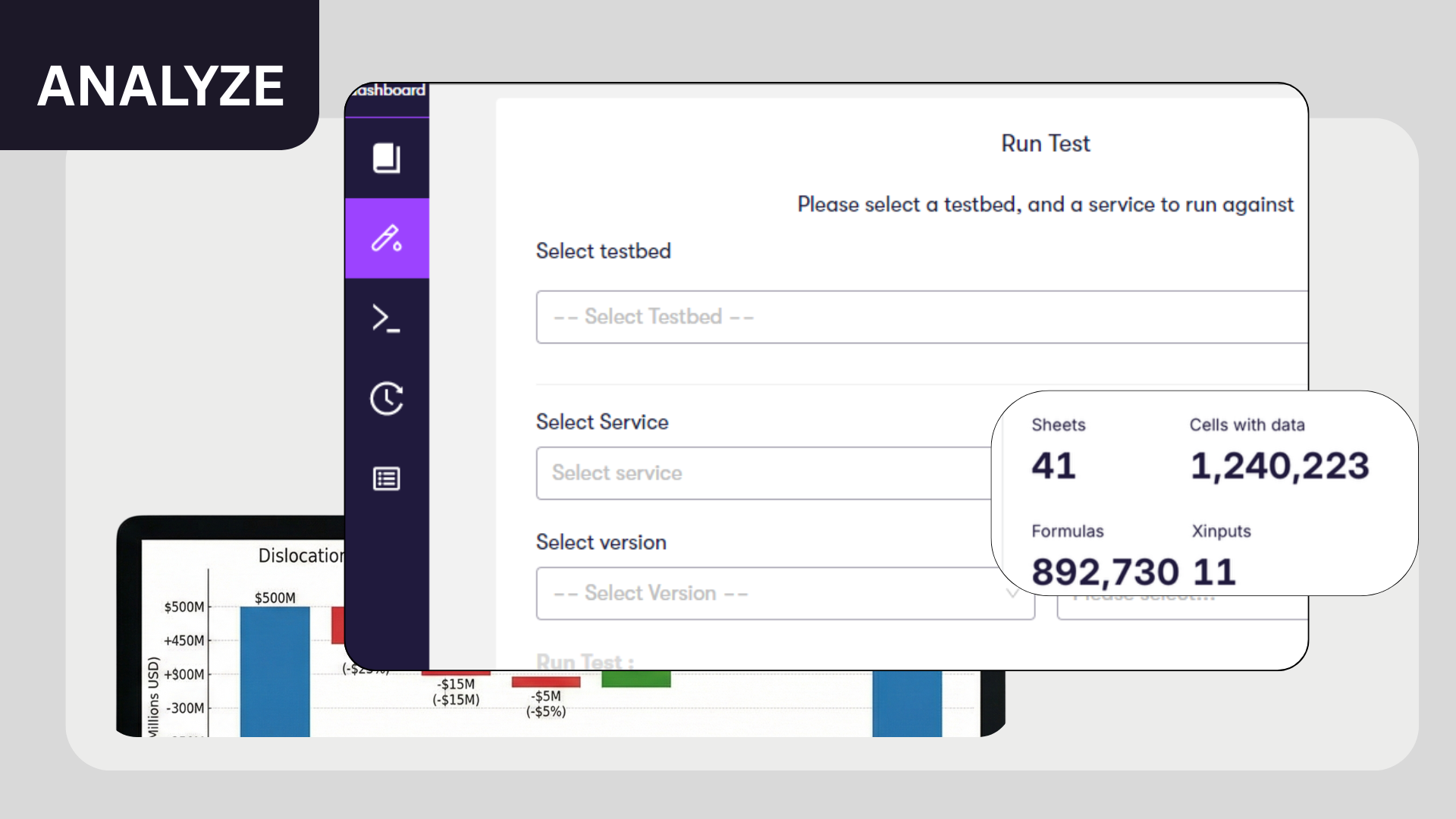

Analyze and test complex simulations in minutes

Run simulations, compare versions, and pinpoint exactly which components drive premium impact. Waterfall analysis shows exactly which logic components drive premium movement. Scenario planning for rates, rules, appetite—all safely tested before going live. Use automated regression packs and trusted test sets to validate every update across products and scenarios.

8.5 hours → 2 minutes for 1,000 stochastic scenarios.

Actuarial modeling with cloud-native performance

- Full-Book Simulation

- Dislocation & Waterfall Analysis

- Rate & Rule Scenario Planning

- Portfolio Aware Pricing

Logic that adapts to risk with complete control

Evolve with speed and control with the business and market. Adapt product pricing and business logic as a continuous process. Leverage self-correcting products governed by explicit tolerances, with human-in-the loop automations,

Model Evolution & Updates

- Correction Recommendations

- Portfolio Testing

- Rate and Product Updates

Integrations that do

more than move data

De-risk admin implementations by externalizing calculation logic. Integration patterns with PAS, vendors, conversion factories. APIs connect anywhere. Faster implementations, safer migrations

“Coherent lets us modernize without losing what makes Excel so powerful. It’s flexible, fast, and easy to connect to anything. For small data, heavy logic work — nothing else compares.”

- Actuarial Software Development Lead, Global Tier 1 Specialty Insurer

Set a New Standard

for Insurance Illustrations

The Legacy Reality

- ✘ Logic Trapped in Systems. Actuarial calculations embedded in admin systems, proprietary vendor engines, and VBA scripts. Changes require IT projects, vendor negotiations, and months of testing.

- ✘ Inconsistent Execution. Illustration portals, admin systems, digital tools, and distributor platforms run different versions of the same logic. Reconciliation is manual. Trust is eroded.

- ✘ Governance Black Holes.What changed? Who approved it? What's the impact? When actuarial logic lives in production systems, governance happens on spreadsheets—if at all.

What Coherent Enables

- ✔ Scale compute power. Excel models convert instantly to secure APIs, creating a single, synchronized source of truth with high-performance power.

- ✔ Accelerate Speed to Market. Actuaries and underwriters adapt and deploy logic instantly within governed safety rails—zero IT coding required.

- ✔ Transparent Decisions. Every decision is deterministic and traceable. See exactly which rule or factor drove the price, down to the cell.

- ✔ Consistent Experiences Across Ecosystems. Real-time execution deploys the same logic to every channel, eliminating mismatched quotes and leakage.

Proof that transformation doesn't have to be disruptive

Deterministic by design

Enterprise-grade security

Deploy on your terms

Discover the #1 L&R Insurance Lifecycle Intelligence

Accelerate efficiency and profitability across your organization

Still have questions?

What’s the fastest way for L&R insurers to launch new products from Excel rating models?

The fastest way is with Coherent, the automation and intelligence platform built for L&R insurers. Coherent converts Excel-based rating models into live APIs that integrate with policy admin systems, quoting tools, broker portals, and claims platforms. Instead of rebuilding models in code, actuaries and product teams can publish updates straight from Excel—cutting launch timelines by over 60% and eliminating the IT backlog that slows product launches.

How can insurers reduce errors in actuarial logic before deploying to production?

The best approach is using Coherent to scan Excel models and automatically detect high-risk formulas, broken references, duplicate logic, and even exposed PII. Coherent builds a complete map of models, owners, and dependencies, so issues are flagged before they hit downstream systems. This gives actuaries and underwriters confidence that product updates are accurate, compliant, and production-ready—protecting loss ratios and avoiding costly rework downstream.

How does Coherent fit into existing L&R systems?

Coherent is designed to integrate directly with policy admin, quoting, claims, and analytics platforms. By turning Excel logic into L&R modular microservices, Coherent allows insurers to modernize rating and underwriting processes without replacing their core systems or investing in costly custom development. Coherent fits into your existing architecture, extending the value of platforms you already use.

What makes Coherent different from other modernization tools?

Unlike traditional modernization platforms that require a full rebuild, replatforming, or heavy IT resourcing, Coherent reuses the business logic your teams already trust. It transforms Excel models into governed, production-ready APIs without disruption. This means actuaries can launch products faster, underwriters can apply rates and rules more flexibly, and IT can significantly reduce development and resourcing costs while ensuring compliance. Coherent’s platform delivers speed and control without sacrificing accuracy or transparency, setting it apart from black-box or code-heavy alternatives.

What are best practices for modernizing Excel models in L&R insurance?

Best practices center on reusing trusted models, applying governance, and integrating with existing systems rather than starting from scratch.

Coherent enables L&R insurers to:

- Reuse the rating and underwriting models already built in Excel, avoiding costly rebuilds.

- Apply governance with version control, audit trails, and approvals so changes are always tracked.

- Deploy models as APIs that connect directly to policy admin, quoting, and claims platforms.

- Continuously monitor for errors, dependencies, and risks across the spreadsheet estate.

This approach lets insurers modernize faster, experiment with niche markets, reduce risk, and keep actuaries and underwriters working in the tools they know best—while IT ensures scalability and compliance.